The Consumer Price Index, which measures the average change in prices for a commonly purchased amount of goods and services, dropped 0.1% from May, which helps decrease the annual rate of inflation to 3% from 3.3% in May, according to the Bureau of Labor Statistics’ latest report.

This is encouraging news for Americans, as is the falling prices of both gas and new and used cars.

Prices Slow To Increase

Consumer prices are increasing at their slowest rate annually since June of 2023.

This is equal to the lowest annual rate since the start of 2021.

Underlying Inflation In “Core” Index Slowed As Well

A “core” index of underlying inflation, which excludes energy and food prices, has also slowed at an unexpected rate.

This core Consumer Price Index (CPI) rose only 0.1% since May, it’s slowest pace since August of 2021, which in turn moved the annual rate of core inflation from 3.4% to 3.3%, which is a low not seen in three years.

Shelter Inflation Also Showing Notable Decrease

A sector which needs a decrease in inflation perhaps more than any other, the shelter index rose only 0.2% during June, marking the slowest monthly increase in three years.

Shelter remains the steepest hill to climb for a slower CPI overall. It alone is about one third of the entire CPI.

Federal Reserve Rate Cut A Growing Possibility

This positive inflation report has increased speculation that a Federal Reserve rate cut could be on the horizon, which would decrease the cost of borrowing money for consumers

Interest rates have been higher than they’ve ever been since 2001, due to the central bank’s attempts to fight inflation.

Wall Street Confident A Rate Cut Will Happen

Reacting to cooling inflation, Wall Street is beginning to be hopeful about the prospect of a Federal Reserve interest rate cut, pricing in an 89% change of at least one rate cut by September 17-18th.

There are risks associated with this assessment, however, as unemployment has also steadily climbed up over the last three months, to land at 4.1% this June.

Stock Market Reacts To Price Decrease

US stocks initially rose at the news of a slowing of inflation, but it did not last and eventually settled even lower than where it began.

The S&P 500 moved so low it went into the negative, while the blue-chip Dow fell 90 points. Nasdaq was flat.

As Consumption Slows, Retailers Cut Prices

A large number of major retailers, including such giants as IKEA, Target and McDonalds, have decreased prices in recent months to combat a slowing of consumer business, and this trend is likely to continue, experts say.

The price of core goods fell on a monthly basis by 0.1% and are down by 1.8% for the twelve months prior to June, according to a Bureau of Labor Statistics report. Food prices, on the other hand, went up slightly with an overall rise of 0.2% overall.

Slight Relief May Not Be Enough For Consumers

Despite prices technically falling, the overall CPI is still 20% higher than it was in February of 2020. This means you are unlikely to hear the average consumer’s excitement over a 0.1% price increase, as their wallets are still being squeezed tight, and they are unlikely to forget it.

As Michael Weber, an associate professor at the University of Chicago Booth School Of Business, notes to CNN “for many consumers, when we look at the price tags…that price tag compared to two, three years ago will be permanently higher, given the cumulative inflation we’ve witnessed over the last three years. It’s ingrained in the memory.”

Possible Effects On The US Presidential Election

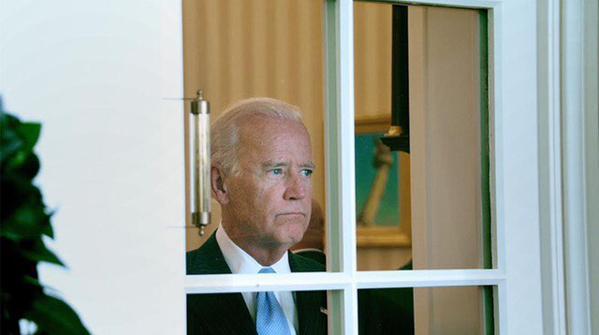

The economic squeeze on consumers could have a huge effect on this year’s Presidential Election, and perhaps not in a positive way for President Joe Biden.

Despite the modest decrease in prices, as Bernard Yaros, lead US economist at Oxford Economics tells CNN, “people aren’t economists…they’re looking at how much a dozen eggs cost now compared to two years ago.”