Paramount and Skydance have agreed to the terms of a merger after spending months attempting to find common ground. The proposed merger would give way to a media empire whose titles would include CBS, MTV, Nickelodeon and more.

The deal is valued at $8 Billion, a significant increase from the $5 Billion offer that was previously on the table. A deal could be announced in the next few days, following Paramount’s annual shareholder meeting on Tuesday.

This New Deal is Worth an Additional $3 Billion

The proposed deal between Paramount and Skydance is valued at $8 billion, up for the previous $5 billion offer on the table. As agreed upon in negotiations, the new deal would not require a vote from shareholders.

Under the new deal, Redstone would receive $2 billion for National Amusements, the parent company of Paramount. Meanwhile, Skydance would buy out approximately 50% of Class B Paramount shares – giving them equity in the new company.

Despite Progress, Uncertainties Remain

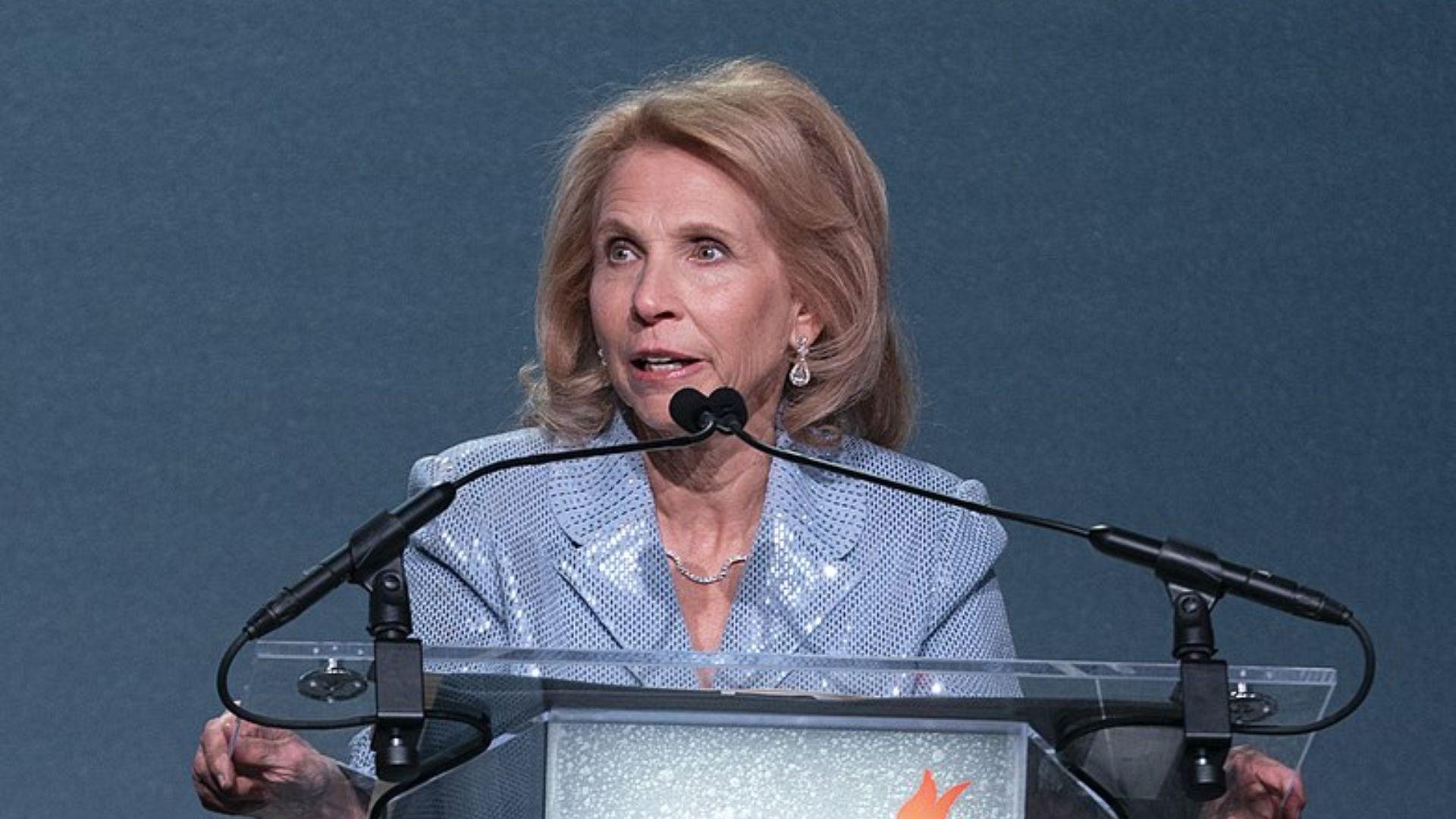

Redstone initiated talks with Skydance’s David Ellison last year about the possibility of a merger with Paramount. On Tuesday, Shari Redstone, the non-executive chairwoman of Paramount Global and president of National Amusements, simply reaffirmed her “confidence” in executives deciding the next steps.

Previously, disagreements over legal protection had provided obstacles to reaching a deal. National Amusements wanted Skydance to provide legal protection in the event that Paramount’s investors sue over the merger. As of Sunday, Skydance had not yet agreed to this condition.

Why is Paramount Under Financial Pressure?

Paramount, like many companies, has been struggling with challenges stemming from Hollywood strikes and declining theater attendance in the streaming age, and has recorded losses over the last year.

However, Paramount minimized their losses in the first quarter of 2024. Its streaming service cut losses to $286 Million in the first quarter of 2024 compared to $511 million in the first quarter of 2023. Much of this was driven by increases in subscription revenue – with an additional 3.7 million new subscribers to Paramount+ in the past three months.

Examining the Potential Impact of a Merger on Beloved Shows

Many fans of Star Trek, which became Paramount property in 1968, have wondered how the merger will impact their beloved show. Given that Skydance Media has a pre-existing relationship with Star Trek co-writer Alex Kurtzman, a merger could be good news for Trek fans.

There are a number of shows on Paramount Plus Streaming whose popularity suggests they’re not going anywhere. Among them are RuPaul’s Drag Race, Awkward and Yellowjackets.

So Who Exactly are Skydance?

While almost all of us are familiar with Paramount, Skydance is a company many people have not previously heard of. Founded in 2006, Skydance is an American production company led by David Ellison, the son of multi-billionaire Larry Ellison.

Titles previously released under the Skydance name include _Star Trek Beyond, Top Gun: Maverick _and _Air_. Later this year, superhero film, _The Old Guard 2, _starring Charlize Theron and Uma Thurman is set to be released on Netflix with Skydance credited as a contributing production company.

Late Deal Changes Could Prove Crucial to Reaching Agreement

In an attempt to improve it’s offer, Skydance agreed to pay $1.5 Billion in debts on Paramount’s balance sheet. Reportedly, Paramount and Skydance have also agreed to allow nonvoting shareholders to sell their stocks at $15 a share.

Another issue that had continued to cause disagrements was whether Paramount would be allowed a “go shop” period. This would give Paramount a time-period to see if it could secure a better offer than that offered by Skydance.

Amidst Possible Deal, Reports of a Competing Offer

The purported agreement between Paramount and Skydance comes after reports of a competing offer from Sony Pictures and Apollo Global Management. In May, those companies expressed interest in acquiring Paramount for approximately $26 Billion.

However, Apollo and Sony reportedly wanted to break up Paramount, while Redstone are said to favor a deal that would keep the company together.

Deal or No Deal, Big Name Changes Promise Shifts

After taking over as CEO of Paramount Global in December 2019, Bob Bakish stepped down from the role in late April 2024. Paramount is now led by three executives, George Cheeks (CBS president), Chris McCarthy (president/CEO of Showtime and Paramount Media Networks), and Brian Robbins (head of Nickelodeon and Paramount Pictures).

Insiders purportedly believe that letting Bakish leave was the correct decision, but the new split leadership has presented negotiation fears. With responsibilities now split among three people, the company has not had a single leading voice during negotiations.

Who is Shari Redstone?

Shari Redstone is the president of National Amusements and serves as non-executive chairwoman of Paramount Global. She has previously been named as one of Time Magazine’s 100 most influential people in the world and one of Forbes Most Powerful Women in 2022.

Paramount has been steered by the Redstone Family ever since family patriarch Sumner Redstone won a bidding war for the studio in 1994. Shari Redstone herself emerged victorious from her own power struggle just five years ago. National Amusements’ 10 percent stake in Paramount adds to Shari Redstone’s status as a power player in the entertainment industry.