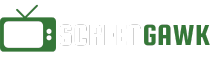

Kayne West, now known as Ye, has been on a rollercoaster these last five years. The rapper’s years have been marked by both personal and professional highs and lows. During one of those lows, Ye revealed that he asked Mark Zuckerberg, the CEO of Meta, for $1 billion when he was in massive debt.

When was Ye in debt? And why did he turn to Zuckerberg? Let’s get into it!

The Last Five Years Have Been Rough on Ye

Over the last few years, Ye has received a large amount of praise and criticism across the entertainment industry for his album, “Donda,” his divorce from Kim Kardashian, and his antisemitic comments on social media platform X, formerly known as Twitter.

The rapper has been known for his high-profile celebrity disputes and far-right tirades, but his hold to success seemed to slip between his fingertips in the last year.

Ye Falls of the Forbes’ Billionaire List

In 2022, Ye landed on Forbes’ billionaire list after gaining a net worth of $2 billion, largely driven by the value of his Yeezy collaboration with Adidas. However, Ye fell off Forbes’ billionaires list in 2023 after losing about $1.6 billion.

His worth fell to about $400 million after losing several business deals after making several antisemitic comments.

Ye Has Found Himself in Debt Before

But this wasn’t the only time Ye found himself pinching pennies. In February 2016, Ye claimed to be $53 million in debt, according to MoneyWise.

In a series of now-deleted tweets, Ye called out Facebook founder and CEO Mark Zuckerberg to invest $1 billion in “Kanye West ideas … after realizing he is the greatest living artist and greatest artist of all time.”

Ye Calls Out Silicon Valley Billionaires

Ye also accused Silicon Valley’s billionaires of not doing enough, writing, All you dudes in San Fran play rap music in your homes but never help the real artists. You’d rather open up one school in Africa like you really helped the country…if you want to help… help me…”

While it is unclear if anyone did invest in Ye, it is not shocking to see multi-millionaires like him spiral into debt.

Other Billionaires Fall Off the Billionaires List

2023 saw other billionaires fall off the Forbes list, with the magazine calling it “another bad year for billionaires.” The ongoing war in Ukraine, inflation surges, and the crypto bubble bursting left nearly half the 2,640 billionaires in the world poorer than they were in 2022.

Some billionaires fared worse, with 254 people falling off the list completely. Among those who are no longer billionaires are Ye, Sam Bankman-Fried, and Yvon Chouinard.

Who Fell Off the List?

The billionaires that were hit the hardest were the tech tycoons. 52 people saw their net worths fall under $1 billion, including the co-founders of the NFT marketplace, OpenSea, and the co-founders of the food delivery app, DoorDash.

44 billionaires from the finances and investments world fell off the list like Capital One CEO Richard Fairbank, and venture capitalist and early crypto backer Tim Draper.

The Debt In America Has Increased

While 2023 provided many challenges to billionaires, it also created many difficulties for the everyday American. The total household debt in the United States rose by 1.3 percent to reach a total of $17.29 trillion by the end of 2023.

These latest numbers from the Federal Reserve Bank of New York show that the four main types of debt (housing, auto, student loans, and credit cards) are growing.

People in the U.S. Are Spending Pandemic Money

According to a JPMorgan research that Business Insider reported on, many Americans are burning a hole into their bank accounts by spending the money they saved during the COVID-19 pandemic.

While the U.S. economy avoided the recession forecast for 2023, the experts are now saying that a soft landing or mild recession is possible in 2024 as interest rates and inflation are still high.

There Is a Chance for a Recession

According to a December 2023 survey from the National Association for Business Economics (NABE), three out of four economists say that there is a 50% or less chance that the U.S. economy will fall into a recession in the next 12 months.

Inflation is expected to slow down, but that does not promise that the rising pieces in food or energy will fall back to their pre-pandemic prices.

Who Is at High Risk?

However, this next year might be looking rough for a certain group of people. According to an analysis from S&P Global, “overextend consumers,” which are individuals who have taken on more debt than they can comfortably manage and repay, “have the least cushion to soften the blows from rising interest rates and weather the corrosive effect of inflation on income and affordability, as well as other economic headwinds.”

With uncertain economic times rounding the corner, it is best to cut back on unnecessary spending, double down on paying debts, and make sure you have emergency savings.

Don’t Ask for Money Online!

While it would be nice to go onto X and ask the biggest billionaires in the U.S. to pay off your debts as Ye did, it is best to try and rely on yourself. There are so many ways you can pinch pennies, like using these tips to help you save money at the grocery store.

The future is unpredictable, but securing your finances doesn’t need a risky billion-dollar online loan! Explore smarter strategies to manage your money and build a stronger financial present.