J.C. Penney announces closure of multiple locations across America. The retail giant targets underperforming stores in Alabama, Texas, and Maine.

This decision affects thousands of employees and loyal customers. Will this be the beginning of the end for the 120-year-old retailer?

Department Store Dilemma: Can They Survive?

Traditional retailers face unprecedented challenges in the digital age. Department store sales have declined by 40% since 2000. J.C.

Penney still operates 660 stores nationwide. How long can these retail dinosaurs hold out against the e-commerce meteor?

Online Shopping: The New Retail Frontier

E-commerce sales grew by 44% in 2020 alone. Amazon captures 50% of all online retail spending in the US.

Traditional retailers struggle to compete with digital convenience. Will brick-and-mortar stores become relics of the past?

COVID-19: The Final Nail in Retail’s Coffin?

The pandemic accelerated the shift to online shopping. In-store retail traffic dropped by 60% during lockdowns.

Many consumers developed new, lasting digital shopping habits. Can traditional retailers recover from this seismic shift?

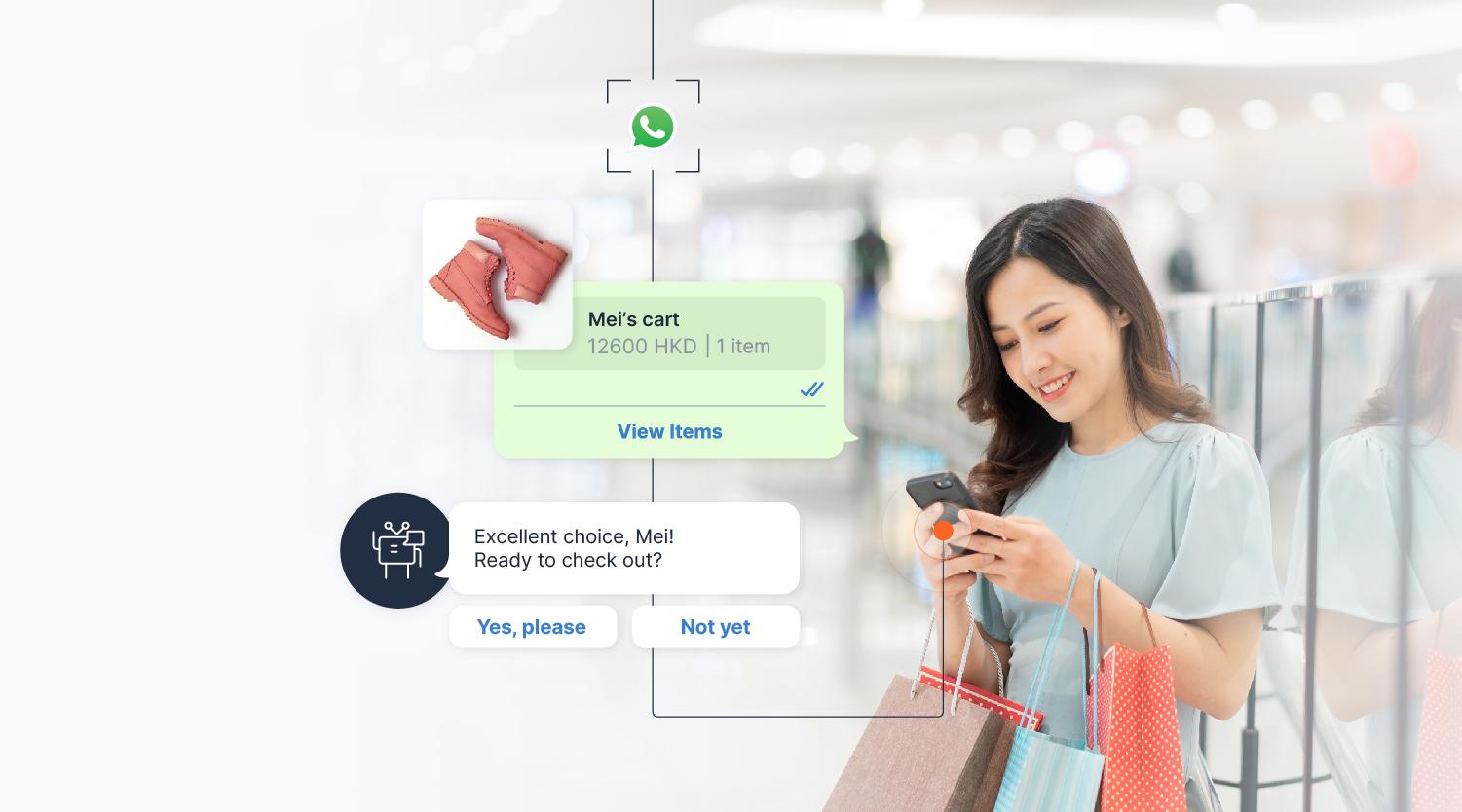

AI and Retail: A Match Made in Heaven?

Artificial intelligence revolutionizes personalized shopping experiences. AI-powered recommendations drive 35% of Amazon’s sales.

Retailers invest billions in AI technology annually. Will smart algorithms replace human salespeople entirely?

The Experience Economy: Shopping as Entertainment?

Retailers focus on creating immersive in-store experiences. Experiential retail can increase foot traffic by up to 40%.

Stores host events, workshops, and interactive displays. Can “retailtainment” save physical stores from extinction?

Omnichannel Retail: Best of Both Worlds?

Retailers integrate online and offline operations seamlessly. 73% of customers use multiple channels during shopping.

Buy-online-pick-up-in-store (BOPIS) sales grew by 208% in 2020. Is this the future of retail?

Customer Service: The Human Touch in Digital Age

Excellent customer service remains crucial for physical retailers. 86% of consumers will pay more for better customer experience.

Personalized service can increase sales by up to 20%. Can human interaction trump digital convenience

What’s Next for J.C. Penney?

J.C. Penney focuses on profitable locations and digital growth. The company aims to reduce overhead costs by 25%.

Online sales now account for 30% of total revenue. Will this strategy secure J.C. Penney’s future?

The Future of Retail: Adapt or Die?

Retailers must embrace technology and innovation to survive. 60% of retail CEOs believe AI will significantly impact their industry.

The global retail market is projected to reach $31.7 trillion by 2025. Who will be the winners and losers in this retail revolution?

Retail Apocalypse: Wave of Store Closures Sweeps US

The US has experienced a significant increase in store closures since 2010. Over 12,000 retail stores closed in 2020 alone.

Major chains like Sears and Toys “R” Us have filed for bankruptcy. The trend has been dubbed the “retail apocalypse” by industry analysts.

E-commerce Impact: Online Shopping Reshapes Retail Landscape

E-commerce sales have grown from 4.2% of total retail sales in 2010 to 21.3% in 2020. Amazon has become the second-largest retailer in the US.

Traditional brick-and-mortar stores struggle to compete with online convenience. Many retailers are shifting focus to their online presence.

Mall Decline: Shopping Centers Face Uncertain Future

The US has seen a 25% decline in shopping malls since 2017. Anchor stores like JCPenney and Macy’s have closed numerous locations.

Mall vacancies reached a record high of 11.4% in 2021. Developers are repurposing mall spaces for mixed-use developments.

Fast Fashion Fallout: Clothing Retailers Shutter Stores

Fast fashion giants like Forever 21 and H&M have closed hundreds of stores. The sector faces increased competition from online retailers.

Changing consumer preferences favor sustainability over disposable fashion. Many clothing retailers are downsizing their physical footprint.

Pandemic Pressures: COVID-19 Accelerates Retail Closures

The COVID-19 pandemic forced temporary closures of non-essential businesses. Many retailers couldn’t survive extended lockdowns and reduced foot traffic.

The COVID-19 pandemic forced temporary closures of non-essential businesses. Many retailers couldn’t survive extended lockdowns and reduced foot traffic.

1980s: Diversification and Continued Growth Strategies In JC Penny

JCPenney acquired Thrift Drug Stores in 1969, expanding into pharmaceuticals. The company launched its insurance services in 1984.

JCPenney’s catalog business peaked in the late 1980s. By 1990, revenues reached $17.8 billion.

1990s: Challenges Emerge in Changing Retail Landscape

Competition from discount retailers intensified in the 1990s. JCPenney struggled to maintain its market position.

The company sold its direct-marketing insurance unit in 1997. By 1998, JCPenney had exited the drug store business.

Early 2000s: Attempts at Modernization and Restructuring

JCPenney launched its e-commerce site in 1998. The company closed 44 underperforming stores in 2000.

A new centralized management structure was implemented. Despite efforts, sales continued to decline.

2010-2012: Leadership Changes and Turnaround Attempts

Ron Johnson became CEO in 2011, promising radical changes. His strategy eliminated coupons and sales events.

This approach alienated core customers, leading to significant losses. Johnson was ousted in 2013 after 17 months.

2017-2019: Brief Stability Followed by Renewed Challenges

Marvin Ellison became CEO in 2015, focusing on omnichannel retail. The company paid off $300 million in debt in 2017.

However, Ellison’s departure in 2018 renewed instability. Sales declined again, reaching $11.7 billion in 2018.