The concept of free money has always felt too good to be true, but this week social media was alight with rumors that a glitch at Chase Bank meant such had suddenly become a reality for some.

The reported glitch allegedly allowed people to withdraw money they didn’t have, up to $50,000, with no consequences.

How Does The Hack Work?

According to Complex.com, the glitch came in the form of check fraud, where people could deposit fake checks for large sums of money.

Reportedly, the glitch prevented these checks from being flagged, allowing the fraudulent transactions to go through.

Chase Takes Swift Action

While Chase “has not acknowledged the virality of the fraudulent transactions”, they have taken actions to rectify the situation.

Chase penalized those who tried to take advantage of the glitch by putting them on seven-day holds and/or leaving their accounts with massive negative balances.

Was The Glitch Ever Real?

A number of malware sites have suggested that many reports of the glitch are unlikely to be genuine.

They added that big banks, like Chase, would almost certainly have security measures in place to prevent such fraudulent transactions.

Separating Fact From Fiction

Amandeep, of CG Wall, wrote “The idea that a glitch exists allowing for unlimited withdrawals is unfounded. Major banks, including Chase, employ advanced security and fraud detection systems that would immediately flag and block unauthorized transactions.

“Therefore, this claim lacks any credible evidence and should be treated with skepticism.”

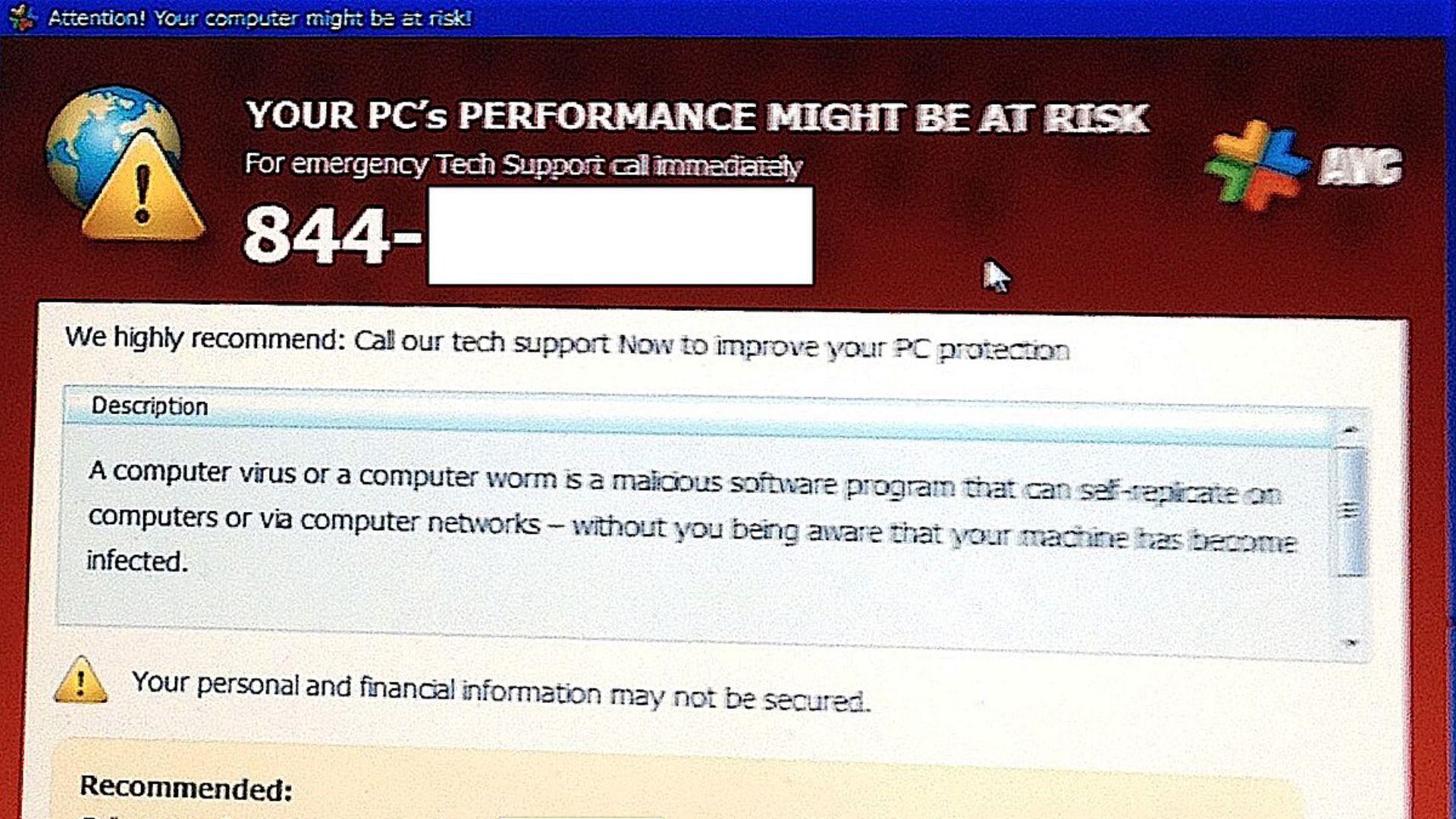

Beware of Scams

Scams, like the unfounded reports of a Chase Bank glitch, can be a cover for phishing and malware schemes.

Such schemes can lead to confidential banking information getting into the wrong hands. Any claims of glitches should be reported to your bank.

Glitch is Not Without Precedent

Similar incidents have been recorded with Cashapp, with users able to transfer large sums of money they didn’t have, and with DoorDash, where customers reported being able to order items without being charged.

In both cases, customers who exploited the scams were left to repay large debts.

How The Chase Bank Glitch Went Viral

A flurry of posts on social media and messaging applications saw the Chase Bank glitch quickly go viral.

Scammers quickly pounced, enticing people with the prospect of free money.

How Social Media Scammers Operate

Malware experts say that many of the social media posts purporting to show people gaining free money from the hack are not all they seem.

Many of these posts used stock photos and doctored screenshots to fool people into believing in the glitch’s validity.

How To Stay Safe From Scams

Claims of bank glitches should be treated with skepticism – especially if they are said to involve free money.

Any suspected scams should be reported to your bank and you should verify any requests to hand over confidential information directly with your bank.